With its stock down 11% over the past three months, it’s easy to overlook Haverty Furniture (NYSE:HVT) . However, stock prices are often driven by the company’s long-term financial performance, which in this case looks promising. In particular, we’ll take a look at Haverty Furniture Companies’ ROE today.

Return on equity or ROE is an important measure used to evaluate how well a company’s management is using the company’s money. In simple terms, it measures the company’s profitability in relation to shareholders’ equity.

Check out our latest review for Haverty Furniture Companies

How Do You Calculate Return On Equity?

The equity recovery process is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the formula above, the ROE for Haverty Furniture Companies is:

15% = US$46m ÷ US$307m (Based on the following twelve months to March 2024).

‘Profit’ is the annual profit. So, this means that for $1 of shareholder investment, the company makes a profit of $0.15.

What Is the Relationship Between ROE and Earnings Growth?

So far, we have learned that ROE measures how well a company generates its profits. Based on how much profit a company reinvests or “saves”, and how well it does so, we are able to assess the company’s potential for earnings growth. Assuming that everything remains constant, the higher the ROE and the retention of profits, the higher the company’s growth rate compared to companies that do not have these characteristics. .

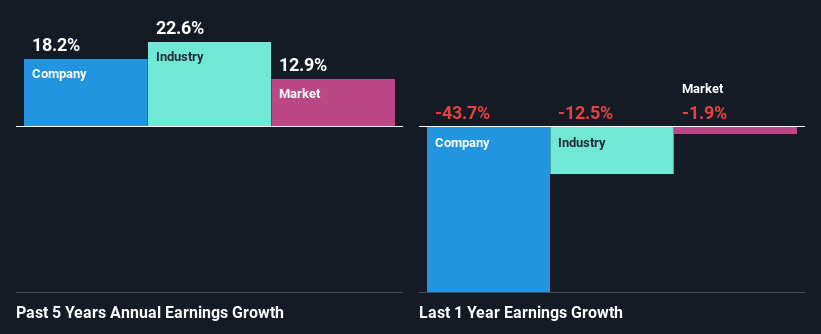

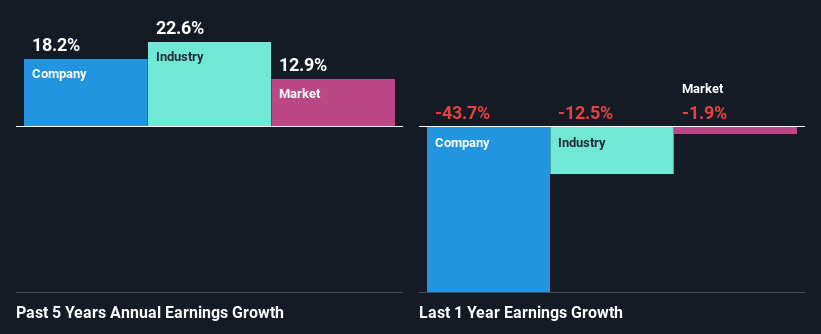

Haverty Furniture Companies Earnings Growth And 15% ROE

For starters, Haverty Furniture Companies appears to have a respectable ROE. Be that as it may, the company’s ROE is still significantly lower than the industry average of 19%. Harverty Furniture Companies has been able to see a positive revenue growth of 18% over the past five years. We think there may be more information here. Like – maintaining high wages or efficient management. Remember, the company has a respectable ROE level. It’s just that the industry’s ROE is high. So this also gives some color to the higher earnings growth seen by the company.

As a next step, we compared the revenue growth of Haverty Furniture Companies to the industry and found that the company has a similar growth rate compared to the industry growth rate of 23% over time that one.

The basis of a company’s value chain is, to a large extent, linked to its earnings growth. An investor should try to find out whether the expected growth or decrease in income, whatever the case, is cheaper. Doing so will help them determine whether the stock’s future looks promising or bleak. Another good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for the stock based on earnings expectations. So, you may want to check whether Haverty Furniture Companies trades at a high P/E or a low P/E, relative to its industry.

Do Haverty Furniture Companies Invest Their Own Profits?

Harverty Furniture Companies has a three-year dividend yield of 20%, which means the company keeps the remaining 80% of its profits. This suggests that management reinvests most of the profits into growing the business.

In addition, Haverty Furniture Companies is committed to continuing to share its profits with shareholders, which we derive from its long history of paying dividends of at least ten years.

Summary

Overall, we are very pleased with the performance of Haverty Furniture Companies. In particular, we like that it has been reinvesting a high percentage of its profits with a moderate rate of return, which has led to dividend growth. That being said, the latest industry analyst estimates reveal that the company’s earnings growth is expected to slow. Are these analyst expectations based on broader industry expectations, or on company fundamentals? Click here to be taken to our estimator page for a company.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Haverty #Furniture #Companies #NYSEHVT #Stock #Shows #Weakness #Assets #Strong #Prospective #Shareholders #Abandoned