Travelers Companies (NYSE: TRV) has been a big hit in the stock market and its stock is up 5.2% in the past month. We wonder what role the company’s financials play in that price change as the company’s long-term fundamentals determine market performance. In this article, we decided to focus on the ROE of Travel Companies.

Return on equity or ROE is an important measure used to evaluate how well a company’s management is using the company’s money. In other words, it is a profit ratio that measures the rate of return on capital provided by the company’s shareholders.

Check out our latest review for Travel Companies

How is ROE Calculated?

ROE can be calculated using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the formula above, the ROE for Travelers Companies is:

15% = US$3.7b ÷ US$25b (Based on the next twelve months to June 2024).

‘Return’ is the profit for the last twelve months. So, this means that for $1 of shareholder investment, the company makes a profit of $0.15.

How Does ROE Relate to Earnings Growth?

So far, we have learned that ROE measures how well a company generates its profits. Based on how much profit a company chooses to invest or “keep”, we can then assess the company’s future ability to make a profit. All else being equal, companies with high return on equity and high retention rates tend to have higher growth rates compared to companies with no equity. the same.

Revenue Growth of Travel Companies and 15% ROE

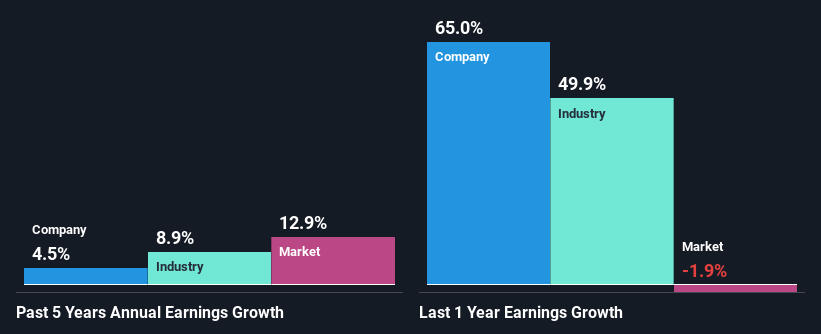

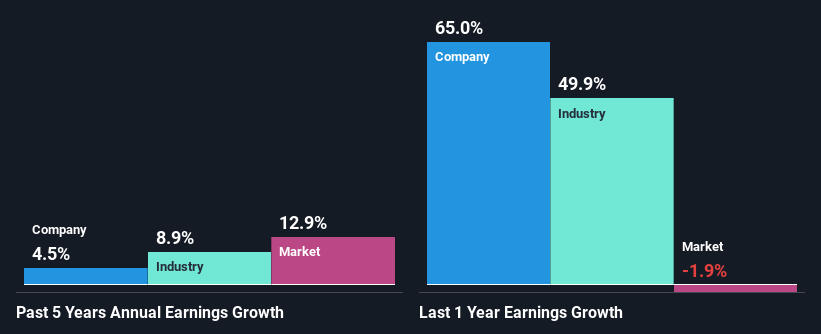

To begin with, Travel Companies seem to have a respectable ROE. Additionally, the company’s ROE is in line with the industry average of 13%. Despite the small profit, Travelers Companies’ five-year revenue growth was very low, at just 4.5%. We think that low growth, when incomes are limited, can be caused by certain conditions such as low income retention or poor income distribution.

Next, when we compare with the growth of the industry funds, we found that the reported growth of Travelers Companies was lower than the growth of the industry of 8.9% in the last few years, something that we don’t like to see it.

Income growth is a major factor in asset value. An investor should try to find out whether the expected growth or decrease in income, whatever the case, is cheaper. This helps them to know whether the stock is set for a bright or bleak future. Are Travel Companies Equal in Value Compared to Other Companies? These 3 quality measures can help you decide.

Are Travel Companies Using Their Revenue Effectively?

Although Travel Companies has a good three-year earnings charge of 26% (or a share of 74%), it has seen very little growth in earnings. Therefore, there may be other reasons to explain the shortage in that regard. For example, business may decline.

In addition, Travelers Companies has paid dividends for at least ten years, which means that the company’s management is willing to pay dividends even if it does not mean earnings growth. Based on the latest estimates of analysts, we found that the average future earnings of the company in the next three years is expected to hold at 23%. As a result, the ROE of Travel Companies is not expected to change significantly, which we expect from the analyst estimate of 15% for the future ROE.

Summary

Overall, we feel that Travelers Companies has good qualities. However, we are disappointed to see the lack of earnings growth even despite the high ROE and high recovery rate. We believe that there may be other external factors that may have an adverse effect on the business. That being said, the latest industry analyst estimates reveal that the company’s earnings are expected to accelerate. To know more about the company’s future earnings growth projections check this out for free report on analyst estimates for the company to know more.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Travelers #Companies #Inc.s #NYSETRV #Stock #Shown #Strong #Strength #Call #Closer #Study #Financial #Prospects